Why Is Buying Real Estate a Good Investment?

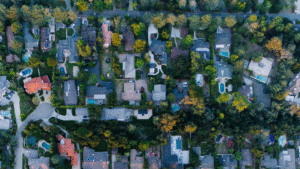

Why Real Estate Remains a Top Investment Choice

For decades, real estate has been one of the most reliable paths to wealth creation. It’s not just about owning land or property — it’s about building equity, generating passive income, and securing long-term financial stability. Unlike stocks or cryptocurrencies, which can rise and fall overnight, real estate offers the advantage of being a tangible, stable, and flexible asset.

1. Property Appreciation

Historically, home values in the U.S. rise by an average of 3–5% annually, with hot markets seeing double-digit growth. Cities with strong job markets have seen property values soar as more people relocate for opportunities. Remember, you also are noting appreciation on the entire value of the home, even though most do not pay 100% cash for a home, thus increasing the ROI on their cash!

2. Rental Income and Cash Flow

Investors love real estate because it can create ongoing monthly cash flow. For example, a $250,000 rental property in a high-demand area could generate $1,800+ in monthly rent — covering expenses and creating profit while the property value increases.

3. Tax Advantages

From mortgage interest deductions to depreciation write-offs, real estate is full of tax benefits that other asset classes don’t offer. These advantages can save investors thousands annually.

4. Hedge Against Inflation

When inflation rises, so do property values and rents. This makes real estate one of the strongest tools for preserving buying power.

How iFinder Helps:

At iFinder, we help you find the properties that make the best investments — whether you’re searching in booming metros like Dallas or Atlanta, or looking for hidden gems in growing suburban markets. Our platform can provide off-market deals, market info, and tailored property matches so you can invest smarter and faster.

👉 Learn more about becoming an authorized investor with iFinder today.

Is buying real estate worth it in 2025?

Yes. Real estate remains one of the most dependable long-term investments, providing appreciation, rental income, and tax benefits.

What makes real estate better than stocks?

Unlike stocks, real estate is tangible, less volatile, and generates both income and appreciation.

View the 4 Most Frequently Asked Questions in Real Estate (per Google)

View the Most Frequently Asked Questions That iFinder Receives...

Explore More Posts on Our Site...

Why Verified Investors Make All the Difference in Real Estate Transactions

Scaling Your Real Estate Portfolio: Investing in 24+ States with iFinder

When Life Changes, So Should Your Selling Strategy

iFinder Offers Surpasses Big Benchmark with $1-Billion in Property Submissions

Sellers Want Control. You Need to Give It to Them.

The 4 Most Frequently Asked Questions in Real Estate

Our Mission & Values

At iFinder, our mission is to make real estate faster, fairer, and more transparent for everyone involved. We believe homeowners deserve options, investors deserve access, and agents deserve new opportunities to succeed. Every offer, connection, and partnership on our platform is built on trust, data, and results. By combining local expertise with modern technology, iFinder helps people make confident decisions about buying or selling property.

How iFinder Works

iFinder simplifies real estate by connecting motivated sellers, verified investors, and experienced agents.

1️⃣ Sellers receive multiple competitive offers without pressure or hidden fees.

2️⃣ Investors gain access to exclusive off-market deals and transparent property data.

3️⃣ Agents leverage the platform to expand their reach and close more opportunities.

Every step is supported by trusted partners and technology which keeps the process efficient and stress-free. Whether you’re buying, selling, or investing, iFinder offers smarter solutions to help you achieve your goals.

Why Choose iFinder

Traditional real estate can be slow, confusing, and one-sided. iFinder changes that by giving you real choices and control. Our team partners with trusted agents and investors to ensure every transaction benefits all sides. With data-driven insights, flexible timelines, and transparent offers, we’re redefining what it means to buy and sell real estate. iFinder isn’t just another property platform — it’s your partner for smarter, faster real estate decisions.

Our Promise

At iFinder, we’re committed to helping people make confident real estate decisions. Every connection we create is backed by integrity, transparency, and expertise. Whether you’re listing your first home or growing an investment portfolio, iFinder offers the knowledge and tools you need to move forward with clarity and confidence.

Get Started with iFinder

Have you checked out the rest of our site? till have questions about iFinder?

Ready to get verified? Contact our team to get started!

Visit us on our social channels, too! Facebook Instagram LinkedIn YouTube

Why Is Buying Real Estate a Good Investment

Why Is Buying Real Estate a Good Investment

Why Is Buying Real Estate a Good Investment